Payroll management is indeed a crucial aspect of any organization, regardless of its size. However, most SMEs still spend their valuable resources on manual payroll calculations. Payroll systems provide a comprehensive solution by reducing the risk of human errors and compliance issues, along with user-friendly interfaces. Integrating a payroll system can help streamline payroll management while increasing the operational efficiency.

Table of Contents:

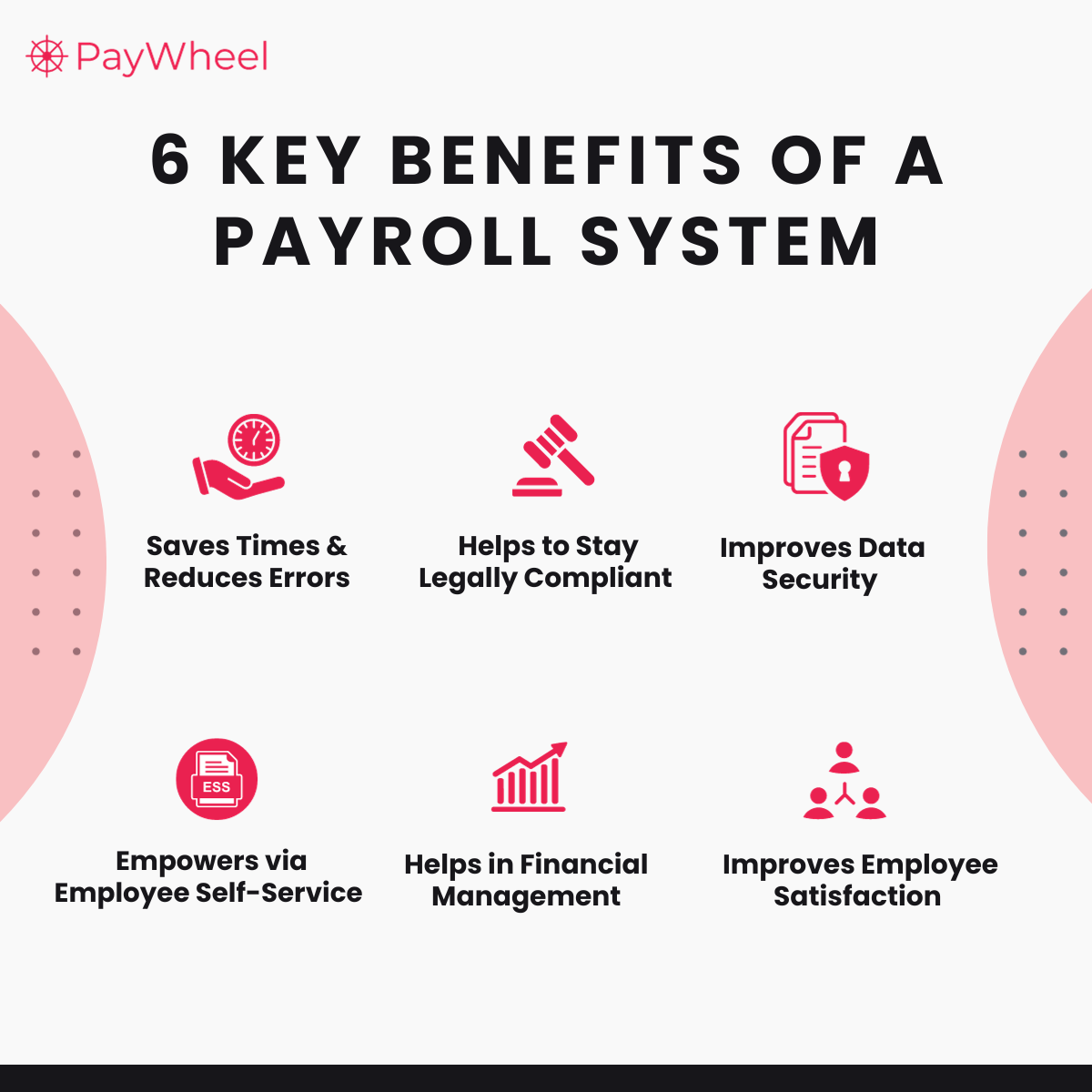

What are the Benefits of a Payroll System?

A payroll system is a software that is designed to automate the process of salary calculations and payroll management. It helps to track employee time and attendance, tax calculations & deductions, generate payslips and more. Unlike manual payroll which can be time-consuming and prone to errors, automated payroll systems leverage technology, reducing the likelihood of mistakes and saving valuable time for both employers and employees.

1. Saves Times & Reduces Errors

Manual payroll processing is often susceptible to costly errors because detailed payroll management can be quite challenging. However, an automated payroll system can streamline payroll calculations & processing, saving time and decreasing the risk of manual errors.

2. Helps to Stay Legally Compliant

Payroll systems help organizations stay compliant with constantly changing labor laws and regulations. It can often be difficult to stay ahead of the various legal requirements and tax regulations. Payroll systems help organizations with the latest updates, maintain accurate employee records, generate tax forms, and with tax calculations.

3. Empowers Employees through Employee Self-Service

Many modern payroll systems provide employee self-service portals. This allows users to obtain their pay stubs, tax records, and other pertinent information online. It also enables employees to update and modify individual information, such as contact information and other relevant data without HR intervention.

4. Improves Data security

Payroll systems are equipped with robust data security to safeguard employee information. There are various facets, such as encryption, access limits, safe backup methods, etc., for the same. Payroll data security is critical for protecting employee privacy and complying with data protection rules.

5. Helps in Financial Management

Financial management is one of the major aspects of any organization. Payroll systems enable accurate record-keeping, which aids in budgeting, estimation, and financial planning. It can also provide insights into resource allocation, labor costs, and tax deductions, enabling organizations to develop a well-planned financial strategy.

6. Improves Employee Satisfaction and Retention

Payroll calculations and salary disbursement are two of the most challenging tasks for HR professionals. Payroll systems, however, can aid in salary calculations and payroll management. It can ensure timely and accurate payments, which helps improve job satisfaction and employee retention in the long run.

Types of Payroll System

1. In-House (Internally Managed) Payroll System

In-house payroll employs internal resources to manage payroll procedures. Payroll is processed by one or more employees within the organization. In this case every aspect of payroll is handled internally, from staying up to date on tax regulations to tax filing/withholding. It can be done manually or with the help of a payroll system. While it provides organizations with authority it also needs dedicated employees, time and expertise.

2. Cloud-Based Payroll Systems

These systems allow businesses to access payroll functions 24/7 through an online portal, through which you can manage your payroll with the help of automation tools. Cloud-based payroll systems like PayWheel provide various options, like employee self-service portals and automated tax calculations with robust data security. It also allows you to track and monitor attendance data, employee records, and tax reports, among others.

3. Professionally Managed Payroll System

Some companies hire an external accountant or a bookkeeper to handle their payroll services if they do not have experienced employees in payroll within the organization. It helps reduce the chance of errors in the processing of payroll, taxes, and deductions. It also ensures that your payroll processes are taken care of systematically. However, in the case of any tax liabilities, it will be the organization that is liable.

4. Agency Managed Payroll Service

There are several agencies that provide complete payroll services. Companies can hire such agencies and they will take up the entire payroll responsibility and will have experts handle payroll calculations, tax filings, deductions, and salary deposits. These agencies can provide assured accuracy and timely payments and reduce payroll risks significantly within organizations.

FAQs

What is the role of a payroll system in compliance with tax regulations?

Payroll systems can help in tracking employee work hours, salary and tax calculations, accurate employee records, and timely tax filings and deductions according to labor laws and regulations.

Can a business change its payroll system?

Yes, businesses can change or transition to new payroll systems according to their evolving organizational requirements. However, there are various aspects to consider while migrating to another payroll system, such as the size of your business, the number of employees, the budget for the system or software, and the basic requirements.

What are the common challenges in payroll management?

Payroll management is a critical component of any business, regardless of its size. However, there are various challenges associated with it, such as changing tax laws and regulations, managing payroll for remote employees, the risk of payroll errors, payroll fraud, compliance risks, and so on.

How does payroll impact employee morale?

Payroll can have a significant impact on employee morale and satisfaction. For example, timely and accurate payroll can have a positive impact on employees as it builds trust in the employer, which leads to higher employee morale and motivation.

What is a payroll cycle?

The payroll cycle, often known as the pay cycle, is the time period between two consecutive paydays. In simple terms, it is the frequency with which a company pays its employees. If a company pays its employees at the end of each month, there is a 30-day gap between two paydays.

Conclusion

In short, a reliable payroll system is critical to organizational success as it plays a huge role in business operations, from maintaining legal compliance to employee satisfaction and organizational reputation. Investing in a modern payroll system like PayWheel can help to streamline operations, improve data security, and empower both employers and employees.