Understanding the foundations of income tax is critical for financial literacy and compliance. However, the process of paying income tax can be quite challenging, especially for first-time filers. Hence, we have compiled a blog that will help you understand the fundamentals of income tax and serve as a road map for those who are new to taxes.

Table of Contents

What is Income Tax?

Income tax is a direct tax imposed by the government on the income of individuals, businesses, and other organizations. It is a progressive tax, which means that the rate of taxes rises as income increases. The fundamental goal of income tax is to provide revenue to the government for different public expenditures and initiatives.

Understanding Financial Year and Assessment Year

In order to understand income tax, it is important to understand the financial year and assessment year and the difference between the two.

The financial year is also known as the previous year. It is a 12-month period that begins every year on April 1st and ends on March 31st of the following year. This is the time period in which the taxpayer earns their income. And so, in other words, it refers to the time period during which income is taxable.

The assessment year refers to the year that comes after the financial year. It is during the assessment year that the income from your preceding financial year is assessed and taxed. For example, if your financial year is 2022-2023, then the assessment year would be 2023-2024.

Understanding Salary & Taxable Income

Understanding your salary structure, including its components, sources of income and tax slabs is important for determining taxable income and any applicable deductions. Taxable income varies according to the type of income. The taxable income for individuals with multiple sources of income will be different compared to a person who receives a salary from an employment contract. The salary slip often contains all the information such as basic salary, house rent allowance, special allowance, professional tax, and employee provident fund contributions.

Some of these components are exempt from tax, such as travel reimbursements, professional tax among others. You can also claim an exemption from HRA or house rent allowance.

Sources of Income

Income tax has been categorized into five categories, and they are taxed under:

Salary Income: This refers to the income received by the individual from employment. This includes the basic salary, bonuses, encashments, gratuity, pension, and other perquisites.

House property Income: This refers to the income an individual receives from their residential or commercial properties, which will be taxed. However, if you have a home loan, then the interest on the loan shall be calculated as a negative income, reducing the taxable income.

Income from Business/Profession: This category refers to the income or profit received from a business or professional activity, which is subject to taxation. The taxable income is calculated by deducting the individual’s expenses from the profit. This includes self-employed people, entrepreneurs and the profits gained from business partnerships as well.

Income from Capital Gains: This refers to the profit earned from the sale or transfer of capital assets, like personal property. This can include real estate, gold, stocks, mutual funds, and so on. The tax rate will be different for short-term and long-term capital gains. While long-term capital gains have a tax rate of 20%, short-term capital gains will have a tax rate of 15%.

Income from other sources: Any income that does not fall within one of the four categories listed above is taxed as income from other sources. This includes interest from banks, lotteries and so on.

Perquisites in Income Tax

In income tax, perquisites are defined as extra perks and other advantages provided by your employer in addition to your basic compensation or salary. However, it excludes the reimbursements provided by your company. It is part of your compensation structure and the CTC (total cost to the firm). Perquisites can be taxable or non-taxable depending on the nature of the benefits provided.

Deductions

Deductions are tax benefits that the Income Tax Department provides in order to reduce the overall tax liability of an individual. Deductions are permitted under Section 80 of the Income Tax Act (sections 80C to 80U). And so, the more number of deductions you avail, the lower the taxable income will be.

Sum of All heads of Income = Gross Income

The simple way to calculate taxable income is Gross Income – Deductions = Taxable Income.

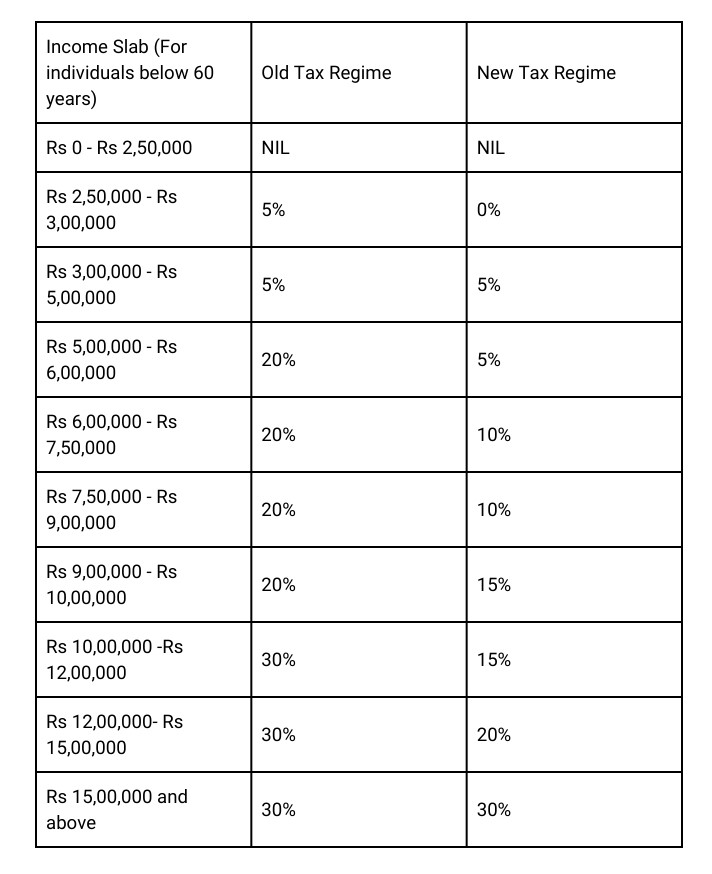

Since the year 2020, there are now two tax regimes which are effective in India, the old tax regime and the new tax regime.

Tax deductions under the Section 80C

The Section 80C is one of the Income Tax Slab is widely used as it can help deduct up to INR 1,50,000 from the gross income of an individual. Some of the most commonly used investments under this section are:

- Public Provident Fund (PPF)

- EPF

- Tax saving FD

- Tax-saving mutual funds or ELSS

Understanding Tax Deducted at Source or TDS

Tax Deducted at Source or TDS is the tax amount deducted and deposited on taxpayer’s behalf by the employer. Companies are required to deduct this tax and submit it to the Income Tax Department within the specified time frame. It is calculated by estimating the annual income of the employee and deducting tax on his income. The tax amount deducted is also based on the income tax slab the individual belongs to. Section 234E imposes a penalty for late TDS payment. There will be a fee of Rs 200 per day until the TDS is paid.

Standard Deduction

The Interim Budget of 2019 introduced the standard deduction of income tax, which replaced the earlier two deductions offered: travel allowance and medical reimbursement. This comes under Section 16 of the Income Tax Act and is fixed for all individuals, regardless of their income.

How to calculate the tax payable?

After calculating the final tax, you must deduct the TDS from your tax liability.

Tax Payable = Tax Liability minus TDS

That is, the tax payable is the amount that is remaining after the TDS deduction from tax liability.

Income Tax Slabs FY 2023-24, FY 2024-25

FAQs

What is income tax declaration (ITD)?

An Income Tax Declaration, or ITD, is a document given by an employee to their employer that contains information about the total income and expenses of the employee. It will also have proof of tax-saving investments such as PPF, life insurance, annuity plans, details of exemptions from allowances such as LTA, HRA, and interest paid for home or education loans, etc. This Income Tax Declaration helps the employee claim tax benefits, thereby reducing the tax liability. The Income Tax Declaration for salaried employees should be sent to the employer who deducts TDS at the end of the fiscal year, in January or February, or as per the employer’s instructions.

What are the documents required for IT declaration?

The documents required to file ITR will differ as per the sources of income, the types of income of each individual. PAN card, Aadhar card and bank details are mandatory for all ITR filing. Apart from that we have listed a set of documents which are commonly required.

Income source: Salary

Documents required:

- Form 16/16A, 26AS

- Rent receipt for HRA

- Payslips

- Investments under Section 80C, 80E, 80D and 80G

Income Source: Capital Gains

Documents required:

- ELSS, SIPs, debt funds, mutual fund statement, purchase and sale of equity/debt funds.

- Stock trading statement if capital gains through selling shares

- Purchase price, selling price, capital gain details and details of registration, in case a house property is sold

Income Source: House Property

Documents required:

- Property Address

- Co-owner (if any) with PAN card & share in capital details

- Rental income details

- Municipal Tax Receipts

- Home loan interest certificate

Income Source: Other Sources

Documents required:

- Bank FD & details of interest received from any savings account

- Income received from post office account

- Reporting of interest received from corporate bonds and tax saving bonds

Conclusion

Indian income tax rules can be hard to comprehend due to their complex framework. Understanding tax exemptions, benefits, and opportunities for investment is essential for decreasing total tax liability and making informed financial decisions. The Indian government is attempting to make this procedure less complicated with online tax filings, so that more people can consider submitting their own returns, thereby increasing the overall number of individual filers. However, manually handling deductions and declarations can be difficult for businesses.

HRM solutions like PayWheel streamline payroll management by automating deductions, calculations, and form generation. Some of the various features of PayWheel include tax report generation, automatic calculations based on tax slabs, and assistance in Form 16 generation. It also handles various forms like Form 12 BA, Form 5A, and Form 24Q, along with state-wise automated PT & PF deductions. Additionally, PayWheel offers reports such as ESIC, PF arrears, exit reports, and IT projections. PayWheel ensures compliance with standard procedures, thereby simplifying the entire payroll management process.