Payroll management is one of the most crucial and challenging processes for any organization. Payroll processing and management has several aspects to it, like timely and accurate payments, which includes regular income, bonuses, and overtime. It also involves adherence to statutory compliance, which includes deductions for income tax, PF, PT, and other mandatory withholdings. Non-adherence to these aspects can have grave consequences, such as conflict within the organization and legal repercussions. And so, it is important for businesses to implement a robust and reliable payroll management system to avoid this.

Table of Contents

What is Payroll Management?

Payroll management encompasses the end-to-end payroll administration, from employee payments, tax calculations to maintaining financial records and ensuring statutory compliance. It also includes tracking overtime, deductions and withholding, and leave encashment, among others. Some of the key aspects of payroll management include:

- Salary Calculation

- Tax Deductions

- Statutory Compliance

- Payment Allocation

- Data Reports

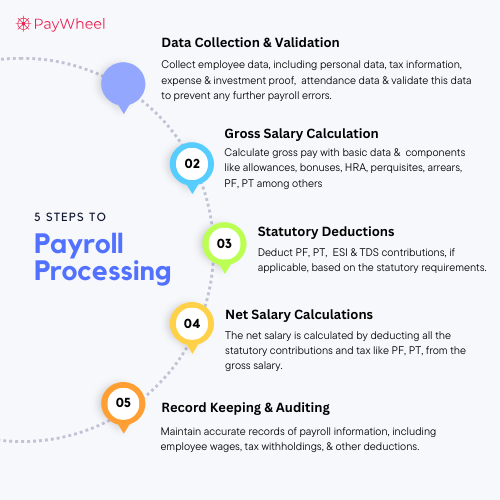

5 Steps of Payroll Processing

With the complex labor laws and regulations, it is important for businesses to follow a systematic approach to payroll processing. Some of the key steps are:

1. Data Collection & Validation

Collecting accurate data is one of the first steps in payroll processing. It may include attendance records, work hours, and time-offs, personal information, reimbursements, expense & investment proofs among others. It is important to collect and validate this data, as it can help prevent any further payroll errors. HRMS systems such as PayWheel offer time-tracking systems & data reports making it much easier to streamline the entire process.

2. Gross Salary Calculation

After data collection and validation, the next step is the gross salary calculation. This may include various salary components such as basic salary, allowances, bonuses, HRA, perquisites, arrears, PF, PT among others. It is important to understand the tax implications of each component during the gross salary calculation to ensure accuracy.

3. Statutory Deductions

Understanding the complexities of income tax slabs, exemptions, and deductions is critical to ensure statutory compliance. There are some mandatory deductions such as Provident Fund (PF) deductions, Professional Tax (PT), and Income Tax. The taxable income is calculated by deducting EPF and professional tax from the gross salary. TDS is withheld from the employee’s salary by the employer based on their income tax slab.

4. Net Salary Calculation

The net salary, or the “take-home” salary refers to the amount that the employee receives after all deductions. This is calculated by deducting all the statutory contributions and tax like PF, PT, from the gross salary. When compared to the gross salary, the net salary amount would be lower due to the numerous deductions.

5. Record-Keeping and Auditing

One of the most important and often undermined steps of payroll processing is record-keeping and auditing. According to the labor laws and regulations businesses in India are by law required to maintain compliance reports, including those related to Provident Fund, Professional Tax, and Income Tax. Regular internal audits also help identify any disparities and helps to ensure smooth payroll processing.

How to Handle Payroll Management Systems?

A robust payroll management system can help streamline payroll processing while reducing the chances of human error. Handling a payroll management system requires a systematic approach. Some of the ways to handle payroll management systems effectively include:

Training Sessions

Training sessions are one of the most critical aspects of effective payroll management. Educate employees about the various functionalities of the software and help them navigate through the system. This will help to enable and empower employees to handle the payroll system effectively.

Be Aware of System Updates

It is important to stay up-to-date on the latest system updates to ensure overall system efficiency. It can also help improve the user experience with new features and functionalities and mitigate the potential risks of outdated software. This proactive approach helps to ensure smooth and stable payroll processing for efficient business operations.

Ensure Data Security

Data security is one of the most important aspects of using any payroll software, considering the sensitive employee information. Ensure data security by regularly checking for updates on bug fixes and patches, as it can help improve system stability. Businesses that emphasize data security in payroll demonstrate a commitment to confidentiality and privacy.

How to Choose the Best Payroll Management Software for Your Business?

Transitioning from a manual payroll to an automated payroll system can help streamline the entire payroll process while improving accuracy and efficiency. Automated calculations help prevent human errors, saving both administrative time and cost. It also helps businesses stay compliant with the changing regulations.

Some of the important factors to consider while choosing a payroll management software includes:

User Friendly Interface

A user-friendly interface that is easy to understand can help users easily navigate through the system. An intuitive user interface also minimizes the need for employee training and guidance. It can also help improve user satisfaction and minimize errors while making payroll processing seamless and efficient.

Scalability

It is important to choose software that can scale according to the evolving needs of a growing business. The software should be able to handle a growing number of employees, payroll data, and processing, and offer flexibility for advanced features if needed.

Cloud-based Software

On-premise software solutions are now outdated as more and more businesses continue to choose cloud-based solutions. Cloud-based software provides various advantages, such as easy accessibility, maintenance and improved data security. Compared to on-premises software, the set-up and maintenance cost is also relatively lower in cloud-based systems. One would not need any infrastructure investment, as all the computing happens securely online.

Employee self-service

Employee self-service feature enables the employee to access and update personal information in the portal. It provides instant information and transparency to employees. It also helps to track their attendance, get manager approvals, apply for leaves, download pay slips and access personal information.

Time and attendance

Most small to medium businesses still struggle with their manual time tracking and attendance data. Organizations which use payroll systems tend to opt for systems that have time tracking, biometric integration, and geo-location based services that help to easily track and calculate the time and attendance of employees, resulting in a seamless attendance tracking system.

Leave and Holiday Management

Payroll software with a leave and holiday feature helps in create custom and geography-based holiday workflows, track leave balances, process leave applications, and obtain manager approvals. It also enables employees to apply for leave and view holidays through the software. This feature improves the leave management process, increasing efficiency in workforce management.

FAQs

What is payroll process in HR?

The payroll process in HR involves managing employee compensation, which includes salary calculations, attendance tracking, employee payments, and tax calculations and deductions. It also includes maintaining data reports and adhering to compliance regulations. Effective payroll processing can have a positive impact on organizational efficiency.

What are the three stages of payroll?

Payroll processing involves many aspects and can be categorized into three major stages:

Pre-Payroll

- Defining payroll policy

- Gathering inputs

- Input validation

Actual Payroll Processing

- Payroll calculation

Post-Payroll Processing

- Statutory compliance

- Payroll accounting

- Payout

- Reporting

What is the significance of payroll management for small businesses?

Payroll management is a critical aspect of any business, regardless of the size of the organization. Efficient payroll management helps to ensure accurate and timely payments, the maintenance of financial records, and compliance with tax regulations. It also helps to save cost and time and improves overall employee experience.

What is the most significant payroll challenges for small businesses?

As there are limited resources for small businesses, there are several challenges associated with small businesses such as:

- Manual payroll errors

- Data security threats

- Staying updated on compliance policies

- Time and resource constraints

Adopting an HRMS solution like PayWheel can help automate and navigate through these challenges, mitigate payroll risks and ensure smooth payroll administration and management.

How often should payroll be processed?

Payroll processing frequency can vary according to each company and depends on the rules and regulations of each organization. There are various frequencies to process payroll on a monthly basis, bi-weekly, and weekly basis. Most organizations in India process payroll on a monthly basis..

Conclusion

Payroll processing is one of the most crucial aspects of any organization. Efficient payroll management plays a crucial role in ensuring accuracy, compliance, and employee satisfaction. It also helps to increase long-term stability and improve overall operational efficiency. Organizations can streamline payroll processing using automated HRMS systems like PayWheel, which has integrated systems for time tracking and compliance management. These integrated solutions provide a comprehensive solution for smooth payroll processing, which improves overall organizational productivity.